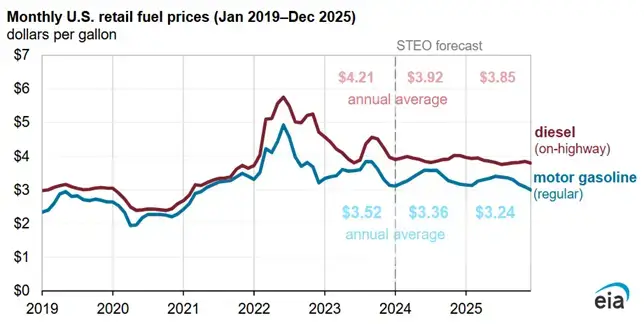

The price of regular gasoline was about $3.484 per gallon in July, then it reduced to $3.137 in October. You see how fuel prices changed within just 3 months. This small price change can greatly impact a business’s budget, especially when they fuel in bulk.

Fuel is the main operating expense in the logistics, transportation, and construction industries. Gasoline price forecasts can help these industries meet their fuel needs and save expenses. Forecasting allows them to predict fuel price changes so they can adjust budgets accordingly and manage risks.

Let’s understand how gas price forecasting can benefit your business.

What is Gasoline Price Forecasting?

Gasoline price forecasting means analyzing different factors and trends to predict future fuel prices. Supply and demand dynamics, geopolitical events, refining capacity, and seasonal patterns are the main factors that need to be evaluated for gas price analysis. Forecasting experts use advanced algorithms for predictive modeling and conduct historical data analysis to identify fuel price patterns.

If you want to carry out a natural gas price forecast, seek professional guidance or analyze market trends using different forecasting techniques.

How Gasoline Price Forecasting Can Benefit Your Business

Gasoline price forecasting can help traders, fleet owners, and industrialists better plan their fuel usage and spending. They can manage budgets, control costs, and avoid unexpected fuel expenses.

Let’s explain this in detail.

● Budgeting and Cost Management

When you forecast future fuel prices using past patterns and market trends, you gain a clear idea of the approximate average fuel cost. Based on these future gas price predictions, you can anticipate price changes and plan your budget effectively. These forecasts allow you to manage your expenses and keep your business operational during sudden price hikes.

● Optimizing Fuel Purchasing Strategies

Analyze future price trends and plan fuel purchases when gasoline or crude oil prices drop. It will help you stock up on fuel at favorable rates and avoid paying higher prices later. Forecast data also helps you negotiate better terms with your fuel suppliers. Reach out to them to lock in contracts when prices are low and request bulk fuel delivery for cost savings.

● Enhancing Pricing Strategies for Products and Services

The increasing fuel prices elevate the transportation, production, and service delivery expenses. However, you can avoid these additional costs by aligning your product or service prices with the expected changes in fuel costs.

Let’s understand this with an example.

Suppose you own a fleet company and need to increase your service charges due to rising fuel prices, but you’re concerned about losing customers. Here, the oil price forecast can help. By knowing that fuel prices will rise in the coming weeks or months, you can plan gradual price adjustments instead of sudden increases. It helps you to adjust your pricing without shocking your customers.

You can also communicate these price changes by explaining the reasons for the adjustment. Use emails, invoices, or social media updates to convey this information to your customers.

● Improving Operational Efficiency

You can improve your business’s operational efficiency by adapting to predicted gasoline price changes. Avoid idling and congested routes to prevent excess fuel consumption. When you know that prices will rise in the future, you can begin fuel-saving practices in advance and maintain a reasonable fuel stock for future needs.

Forecasting data can also help plan fuel-efficient operations, such as optimizing delivery routes and maintenance schedules. You can maintain your vehicles or machinery to ensure they run efficiently, with less fuel usage.

● Risk Mitigation

Use price forecasting wisely to mitigate the risks arising from sudden price changes. If a forecast shows a price spike, buy fuel in advance at lower rates to minimize the impact of future increases. On the other hand, if gas prices in the US are expected to drop, delay fuel purchases to save money.

Forecasting can also help you decide when to use future contracts. When you anticipate higher prices in the future, you can make a contract to lock in current prices for future deliveries.

Tools and Resources for Gasoline Price Forecasting

Businesses can use a variety of tools and resources to forecast gasoline prices accurately. Here are some of the most helpful tools and methods to consider for forecasting gasoline prices.

● Gasoline Price Indexes and Market Reports

The U.S. Energy Information Administration (EIA) provides accurate data about gasoline and other fuel prices. The gasoline price indexes and market reports from EIA help businesses understand market shifts and forecast price changes.

These reports include real-time trends and future projections, covering global oil supply, refinery capacity, and demand patterns. You can download a full spreadsheet of EIA data at eia.gov and track gasoline price predictions for the next 5 years easily.

● Forecasting Software and Platforms

Businesses can use integrated fuel forecasting tools and software to predict gasoline prices. These tools analyze market trends, fuel demand, and supply factors. Software like WEX and GasBuddy provide historical pricing and up-to-date market analysis.

You can identify cost-effective strategies and mitigate price fluctuations by optimizing fuel procurement using these valuable market forecasts. Such forecasting software and platforms also make custom forecasting models for large companies, making the process more accurate and suitable for regional needs.

● Professional Consulting Services

Businesses can also forecast gasoline prices by working with industry experts who specialize in market trends and fuel cost analysis. These professionals can offer better predictions about the crucial factors that may cause a rise in fuel prices.

They closely evaluate changes in global supply, geopolitical events, and economic shifts to analyze the possible outcomes related to gas prices.

Challenges and Limitations of Gasoline Price Forecasting

Global events, political instability, and natural disasters can shake up fuel prices. For example, conflicts in oil-producing regions or hurricanes disrupt fuel supply chains and lead to price hikes. The rapid changes in demand or sudden political decisions may cause prices to deviate from predictions.

These factors make it difficult to rely fully on forecasting models, as predictions can be wrong in either direction. While experts use advanced tools, there’s never a 100% guarantee that a forecast will be completely accurate. So, you must also consider your budget and long-term business potential to make a final decision about purchasing fuel.

Tips for Implementing Gasoline Price Forecasting

Forecasting isn’t a one-and-done task. You can’t simply forecast gasoline prices and make decisions blindly. One wrong decision can severely impact your company’s progress.

You must be clear about your approach and carefully evaluate market changes, track new trends, and update your forecasting strategies to maintain accurate predictions. If you manage a mixed fleet with both unleaded and diesel vehicles, it’s important to calculate costs separately for each fuel type.

When forecasting short-term fuel prices, you can focus more on immediate market changes and geopolitical factors. On the other hand, if you want to predict gas or diesel prices for the next 5 years, you must consider the relevant data, statistics, and economic trends.

Key Takeaways

Gasoline price forecasting helps you determine how much fuel to stock up for future needs. This allows you to manage budgets and reduce risks effectively. The authentic market reports and forecasts enable businesses to adapt faster to market changes. So, you must explore reliable forecasting tools and strategies to stay ahead and succeed in an unpredictable fuel market.

FAQs

What is the future for gasoline prices?

Gasoline demand might grow by 1.2 million barrels per day in 2025, especially in over-populated countries like China and India. Geopolitical tensions could further increase prices. However, advancements in fuel efficiency and the shift to alternative energy may reduce long-term demand.

How much will gasoline cost in 2025?

EIA forecasts that gasoline prices may decrease from $3.30 per gallon in 2024 to $3.20 in 2025. Brent crude oil prices are expected to average $78 per barrel in early 2025 but may fall to $74 per barrel in the year’s second half due to increasing global production and inventory growth.

What is the gasoline market forecast?

The gasoline prices may slightly reduce in 2025 by less than 1% due to the rise in fuel supply. Crude oil prices are also expected to decrease in 2025, which can further reduce gasoline costs.

Will gasoline become cheaper?

Gasoline price forecasts indicate that it might become cheaper in 2025 as the Middle East’s fuel refining capacity is increasing. However, unexpected events like refinery shutdowns or trade issues could still cause temporary price spikes.

How much did a gallon of gas cost in 2024?

In November 2024, the average price of regular gasoline in the United States was about $3.09 per gallon. However, rates can vary between cities due to different tax rates and local fuel regulations. Some areas may experience slightly higher or lower prices depending on regional factors.

How much would gas be in 2030?

Gasoline prices may fall between $10 and $16 per gallon in 2030. The increase in oil production and supply might lower costs compared to previous years. However, inflation, currency devaluation, and rising global demand will likely keep prices high.

Forecast Gas Prices Accurately and Schedule Low-cost Deliveries with Fuel Logic!

Once you have properly analyzed gasoline price patterns and market trends, you can gain insights into future trends, such as whether prices will increase or drop.

Let’s say forecasts indicate the possibility of rising fuel prices. How would you benefit from this prediction?

You can immediately contact Fuel Logic to order bulk gasoline at ongoing lower rates and avoid higher prices in the future. Alternatively, you can schedule fuel deliveries for the future at current prices.

As a trustworthy fuel delivery agency, we deliver gasoline, DEF, and diesel fuel across various locations in the US, though rates may vary from state to state.

Order from us to get high-quality off-road diesel or gasoline at reasonable prices. You can also call us for expert advice and go through our FAQ section to get answers to your queries.