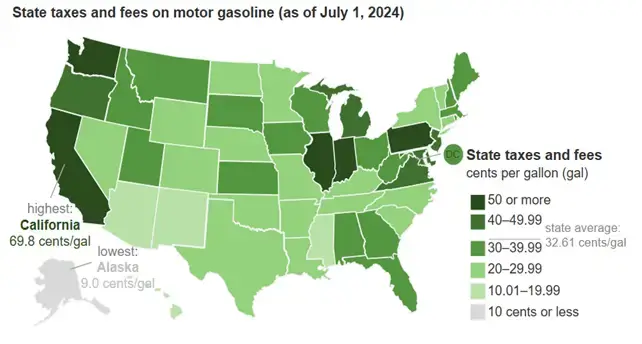

Fuel taxes place a heavy financial strain on drivers and businesses across the U.S. When we average total state taxes across the U.S., they pay approximately 32.61 cents per gallon on gasoline and 34.76 cents per gallon on diesel.

The increase in fuel taxes by the state and the federal government badly affects consumers, businesses, and the transportation industry. Due to higher fuel tax rates, consumers pay more for commuting, and businesses face higher operating costs. Similarly, the transportation industry feels the impact and increases its service charges to manage the high tax burden.

Fuel tax rates differ by state. In January 2024, consumers and businesses in California paid an astounding 68.1 cents per gallon in fuel taxes, the highest in the nation. Illinois followed closely with a tax rate of 66.5 cents per gallon.

Read on to discover the factors influencing fuel taxes and how these taxes affect various industries and businesses. We’ll also discuss gas taxes by state from highest to lowest.

What Are Fuel Taxes?

Fuel taxes are excise taxes charged on the sale of fuel. They vary for gasoline, diesel, aviation fuel, and jet fuel. The purpose of collecting fuel taxes is to fund highway repairs, maintenance, and other government infrastructure projects. Diesel fuel taxes are higher than gas taxes because diesel vehicles use more roads and pay more for road maintenance. However, some states tax diesel at lower rates than gasoline.

Fuel taxes also help reduce pollution by encouraging people to use less fuel and choose greener options like fuel-efficient cars or public transit. The IRS collects these taxes in different ways, such as per-gallon taxes, excise taxes on wholesalers, and general sales taxes on fuel purchases at federal and state levels.

Federal Fuel Tax

The tax imposed on fuel by the federal government is known as the federal fuel tax. Federal fuel taxes have a uniform rate across the country. In the U.S., the federal gas tax is about 18.3 cents per gallon and the federal tax on diesel fuel is 24.3 cents. The federal government uses these taxes to fund transportation-related projects, such as highway and bridge construction.

State Fuel Taxes

State fuel taxes are taxes levied by individual states on the sale of fuel. The gas taxes by state differ from federal taxes because they vary from state to state. Each state’s local legislation, transportation budgets, and infrastructure requirements differ, so tax rates are set accordingly. If a state needs more capital to fix its infrastructure and transit projects, the fuel taxes are higher there. For example, the state fuel tax in California is 69.8 cents per gallon, while in Alaska, it’s 9.0 cents per gallon in July 2024.

Factors Affecting Fuel Taxes

The federal and state governments formulate and amend fuel tax policies. The federal government imposes a standard tax that remains the same in all states, while state taxes vary in different states. Fuel tax rates differ across states due to local economic conditions, infrastructure needs, and government policies.

States with large populations or needing to maintain more roads may set higher taxes to fund transportation projects and infrastructure developments. Economic conditions like inflation, fuel prices, and recessions can impact fuel tax rates. Therefore, governing bodies in different states adjust taxes to stabilize the economy.

Apart from economic conditions, environmental regulations also affect fuel taxes. When there is a higher risk of pollution due to increasing numbers of vehicles that emit harmful gases, environmental regulatory authorities may propose raising taxes to increase diesel rates or gas prices in the US. Higher fuel taxes push drivers and fleet owners to switch to alternative options to save money. They shift to hybrid or electric vehicles, which helps reduce pollution.

Current Fuel Taxes by State for 2024

| S.No | US States | Gasoline | Diesel | ||

| State Tax | State & Federal Combined Tax | State Tax | State & Federal Combined Tax | ||

| 1 | Alabama | $0.3020 | $0.4860 | $0.3195 | $0.5635 |

| 2 | Alaska | $0.0895 | $0.2735 | $0.0895 | $0.3335 |

| 3 | Arizona | $0.1900 | $0.3740 | $0.1900 | $0.4340 |

| 4 | Arkansas | $0.2500 | $0.4340 | $0.2880 | $0.5320 |

| 5 | California | $0.6982 | $0.8822 | $0.9212 | $1.1652 |

| 6 | Colorado | $0.2818 | $0.4658 | $0.3068 | $0.5508 |

| 7 | Connecticut | $0.2500 | $0.4340 | $0.4920 | $0.7360 |

| 8 | Delaware | $0.2300 | $0.4140 | $0.2200 | $0.4640 |

| 9 | District of Columbia | $0.3490 | $0.5330 | $0.3490 | $0.5930 |

| 10 | Florida | $0.3860 | $0.5700 | $0.3947 | $0.6387 |

| 11 | Georgia | $0.3305 | $0.5145 | $0.3695 | $0.6135 |

| 12 | Hawaii | $0.1850 | $0.3690 | $0.1850 | $0.4290 |

| 13 | Idaho | $0.3300 | $0.5140 | $0.3300 | $0.5740 |

| 14 | Illinois | $0.6710 | $0.8550 | $0.7460 | $0.9900 |

| 15 | Indiana | $0.5610 | $0.7450 | $0.6000 | $0.8440 |

| 16 | Iowa | $0.3000 | $0.4840 | $0.3250 | $0.5690 |

| 17 | Kansas | $0.2504 | $0.4344 | $0.2703 | $0.5143 |

| 18 | Kentucky | $0.2780 | $0.4620 | $0.2480 | $0.4920 |

| 19 | Louisiana | $0.2093 | $0.3933 | $0.2093 | $0.4533 |

| 20 | Maine | $0.3140 | $0.4980 | $0.3187 | $0.5627 |

| 21 | Maryland | $0.4629 | $0.6469 | $0.4704 | $0.7144 |

| 22 | Massachusetts | $0.2737 | $0.4577 | $0.2737 | $0.5177 |

| 23 | Michigan | $0.4980 | $0.6820 | $0.5140 | $0.7580 |

| 24 | Minnesota | $0.2880 | $0.4720 | $0.2880 | $0.5320 |

| 25 | Mississippi | $0.1840 | $0.3680 | $0.1840 | $0.4280 |

| 26 | Missouri | $0.2749 | $0.4589 | $0.2749 | $0.5189 |

| 27 | Montana | $0.3375 | $0.5215 | $0.3050 | $0.5490 |

| 28 | Nebraska | $0.3050 | $0.4890 | $0.2990 | $0.5430 |

| 29 | Nevada | $0.2381 | $0.4221 | $0.2775 | $0.5215 |

| 30 | New Hampshire | $0.2383 | $0.4223 | $0.2383 | $0.4823 |

| 31 | New Jersey | $0.4235 | $0.6075 | $0.4935 | $0.7375 |

| 32 | New Mexico | $0.1888 | $0.3728 | $0.2288 | $0.4728 |

| 33 | New York | $0.2568 | $0.4408 | $0.2388 | $0.4828 |

| 34 | North Carolina | $0.4065 | $0.5905 | $0.4065 | $0.6505 |

| 35 | North Dakota | $0.2303 | $0.4143 | $0.2303 | $0.4743 |

| 36 | Ohio | $0.3850 | $0.5690 | $0.4700 | $0.7140 |

| 37 | Oklahoma | $0.2000 | $0.3840 | $0.2000 | $0.4440 |

| 38 | Oregon | $0.4000 | $0.5840 | $0.4000 | $0.6440 |

| 39 | Pennsylvania | $0.5870 | $0.7710 | $0.7410 | $0.9850 |

| 40 | Rhode Island | $0.3812 | $0.5652 | $0.3812 | $0.6252 |

| 41 | South Carolina | $0.2875 | $0.4715 | $0.2875 | $0.5315 |

| 42 | South Dakota | $0.3000 | $0.4840 | $0.3000 | $0.5440 |

| 43 | Tennessee | $0.2740 | $0.4580 | $0.2840 | $0.5280 |

| 44 | Texas | $0.2000 | $0.3840 | $0.2000 | $0.4440 |

| 45 | Utah | $0.3715 | $0.5555 | $0.3715 | $0.6155 |

| 46 | Vermont | $0.3261 | $0.5101 | $0.3300 | $0.5740 |

| 47 | Virginia | $0.4040 | $0.5880 | $0.4150 | $0.6590 |

| 48 | Washington | $0.5282 | $0.7122 | $0.5282 | $0.7722 |

| 49 | West Virginia | $0.3570 | $0.5410 | $0.3570 | $0.6010 |

| 50 | Wisconsin | $0.3290 | $0.5130 | $0.3290 | $0.5730 |

| 51 | Wyoming | $0.2400 | $0.4240 | $0.2400 | $0.4840 |

(Tax rates in dollars per gallon as of July 2024)

When we consider the fuel tax rates of July 2024, California surpassed every other state, ranking the highest in fuel taxes. The state tax on gas was $0.6982 per gallon and $0.9212 per gallon for diesel. In contrast, Alaska had one of the lowest rates, with just $0.0895 per gallon for both gas and diesel.

Florida levies relatively high gasoline and diesel taxes, including the state tax, inspection fee, local option tax, and pollutants tax. While some states are increasing fuel taxes, others are offering relief. For example, New York’s Governor Kathy Hochul recently highlighted the state’s ongoing efforts to deliver $2.3 billion in tax relief under the School Tax Relief program.

Impact of Fuel Taxes on Businesses and Consumers

Fuel taxes increase the cost of fuel and eventually impact consumers’ total expenses. The transportation sector and other businesses face higher operating expenses as they have to spend more as tax on each gallon of fuel they use. As a result, these businesses raise their product or service prices, burdening consumers who rely on them. This increase in fuel taxes adds to inflation in the country.

We know the tax collected by the government is used for developing a country’s infrastructure and helps reduce pollution by encouraging cleaner energy use. However, there is a downside as well. Higher tax rates lead to increased fuel and transportation costs, which can strain small businesses and low-income consumers. Let’s understand the impact of these taxes in detail:

● For Consumers

When fuel taxes rise, the price per gallon goes up, and consumers pay more every time they fill up their vehicles. Higher fuel prices increase the transportation expenses of daily commuters and families. Consumers pay different amounts in taxes depending on their state’s tax rates.

Residents of California pay 68.1 cents per gallon, which is high, whereas consumers in Alaska pay less, at 8.95 cents per gallon. In addition to these state taxes, the federal tax also adds to the cost of fuel, increasing the price even further.

● For Businesses

Higher fuel taxes increase operational costs for businesses that offer logistics and delivery services. These businesses use large amounts of fuel to move goods, and when fuel prices rise due to higher taxes, their fuel expenses also increase.

Therefore, they raise the prices of their products or services to cover these operating expenses. In such situations, small businesses with limited sales may not be able to bear these additional costs, so they reduce their profit margins to maintain their sales.

● Impact on the Transportation Industry

States with higher fuel taxes increase trucking companies’ operational costs. The long-haul trucking industry manages these extra costs by raising shipping charges, which are passed down to consumers. However, some states offer incentives or tax breaks to businesses to help offset these high fuel taxes.

Key Takeaways

You must stay updated on fuel tax rates to manage your personal and business expenses. As fuel tax rates increase and negatively impact fuel-intensive operations, you should monitor how these taxes affect your budget.

The federal and state governments may continue to raise fuel taxes as they plan for more infrastructure and environmental initiatives. Therefore, it’s important to keep an eye on fuel tax policies in your state to make suitable plans for fluctuations and adjust your expenses accordingly.

FAQs

What state has the highest fuel tax?

California has the highest fuel tax in the U.S. at 68.1 cents per gallon.

How much is the federal tax on a gallon of gasoline?

The federal tax on a gallon of gasoline is 18.3 cents.

What is the Wisconsin gas tax?

The gas tax in Wisconsin is 32.9 cents per gallon.

How much is the gas tax in Texas?

The gas tax in Texas is 20 cents per gallon.

Who pays the most tax on fuel?

The transportation sector pays the most tax on fuel because fuel taxes are included in the price paid at the pump. Trucks, buses, and other vehicles in the sector use large amounts of fuel, so they contribute more to the taxes collected.

What is the most heavily taxed state?

The most heavily taxed state for fuel is California. The state tax on gas is 68.1 cents per gallon, and on diesel, it’s 92.12 cents, which is the highest in the U.S.

Get Your Desired Fuel Delivered at Reasonable Rates Across the U.S.

Worried about rising fuel taxes in your state?

Order from Fuel Logic today and we’ll deliver high-quality fuel to your location at competitive prices.

Fuel Logic is a renowned fuel delivery agency that offers the best gasoline, DEF, and diesel fuel deliveries to various industries and businesses across the U.S. With rising inflation, we ensure that we don’t overcharge for fuel deliveries.

We deliver fuel at standard gas rates in the U.S.

You can schedule regular bulk fuel deliveries or urgent orders so you don’t run out of fuel.

Contact us today to lock in low rates and secure reliable fuel delivery for your business.

Don’t let rising gas or off-road diesel costs hold you back.

Reach out for expert advice or visit the FAQ section on our website to address your concerns.