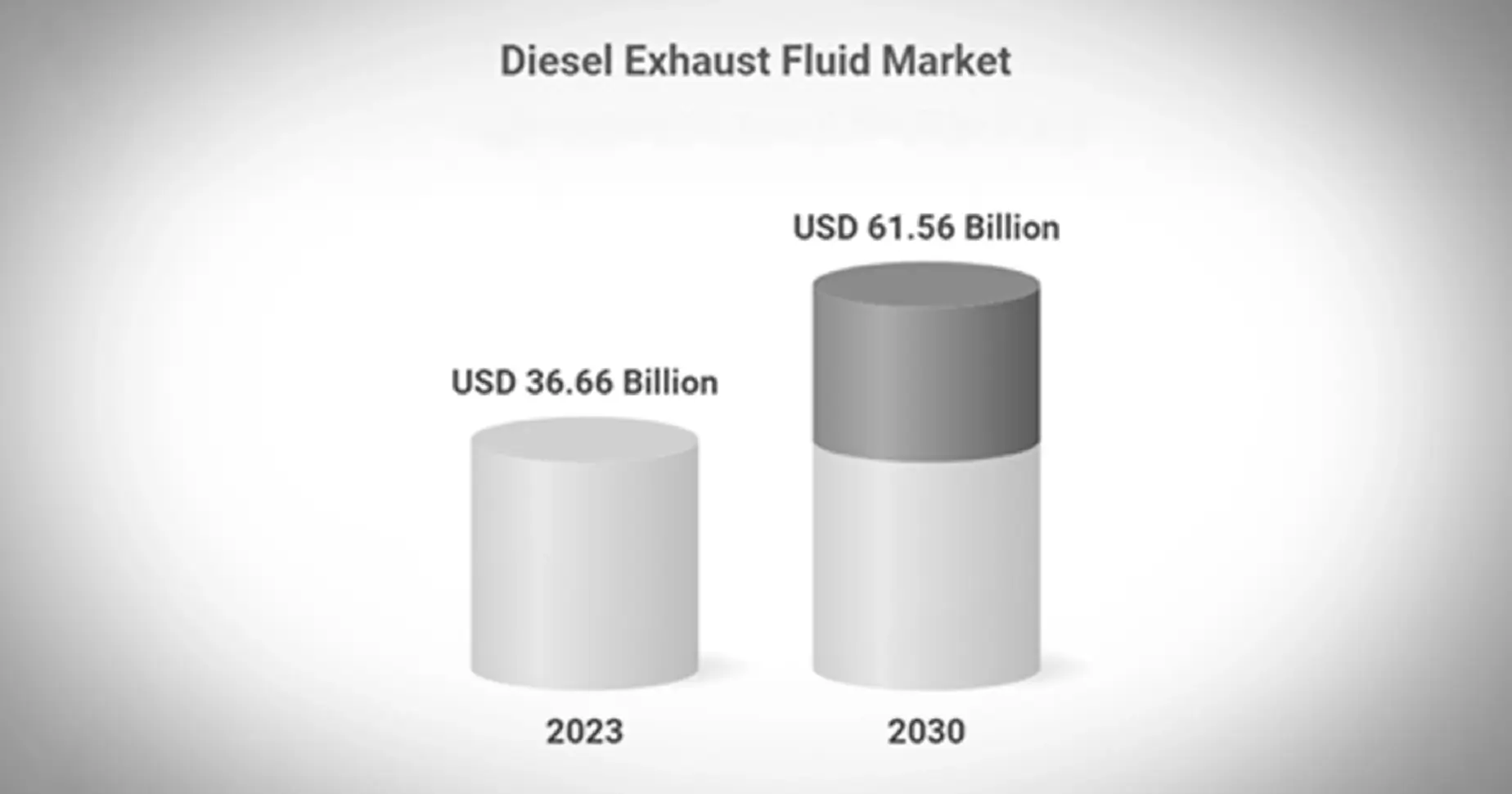

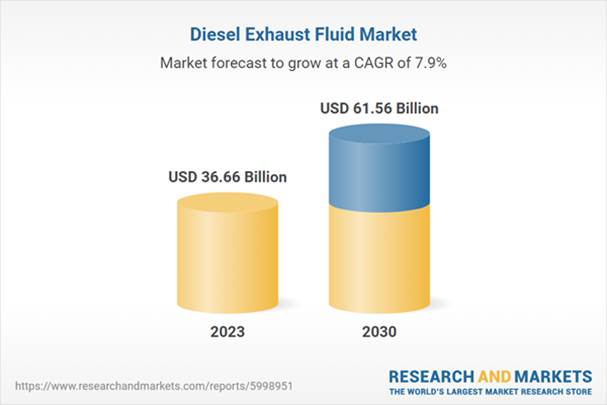

The Diesel Exhaust Fluid market exhibits a projected growth rate of 7.9% compound annual growth rate (CAGR) between 2024 and 2030. This will drive it to reach $61.56 billion in 2030. The Diesel Exhaust Fluid (DEF) market continues to expand rapidly due to the businesses’ understanding that it provides crucial emission reduction for regulatory needs.

However, this is not the only reason for the increasing Diesel Exhaust Fluid demand. This post shares DEF market trends, global and regional insights, future projections to 2030, and key challenges with potential opportunities.

Key Trends Shaping the DEF Market

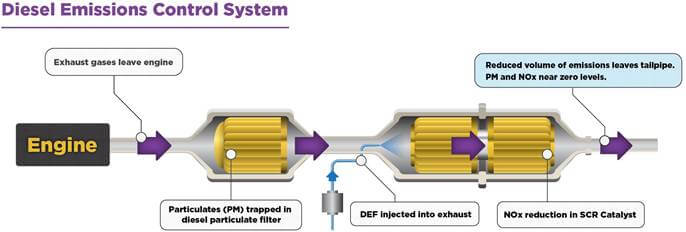

The Diesel Exhaust Fluid composition consists of urea alongside de-ionized water. A Selective Catalytic Reduction (SCR) system uses this mixture to convert toxic nitrogen oxide (NOx) pollutants into harmless nitrogen gas with water molecules. Multiple trends are shaping the DEF market, which include:

Environmental Regulations

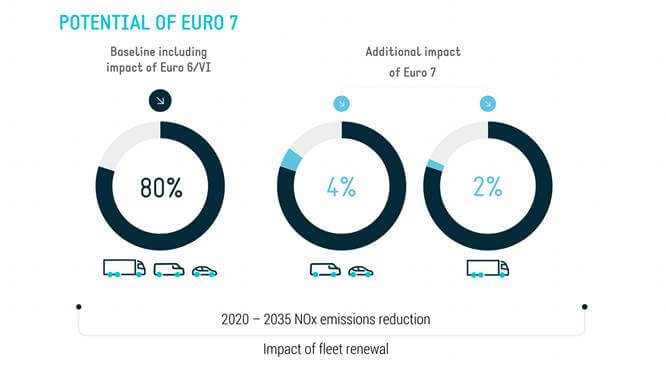

Worldwide, strict environmental regulations accelerate the market demand for DEF. Due to the European Euro 6 standards and American EPA Tier 4 standards, the implementation of SCR technology into diesel engines has become mandatory for automobile makers.

In fact strict emission regulations are pushing Europe and India to adopt SCR technology to reduce NOx emissions to more than 80%. This can only happen if DEF enters the exhaust pathway through injection. Because of these rules, diesel vehicle makers and operators must use DEF to stay compliant, which is driving strong demand for it in the market.

Adoption Across Industries

The application of Diesel Exhaust Fluid (DEF) advances outside automobiles because transportation companies, construction firms, and agricultural operations are now implementing it. Transportation organizations must add DEF to their diesel-powered vehicles since regulatory requirements are driving its demand.

Heavy machines that operate in construction activity must comply with recent emission regulations, so they are using DEF at higher levels. Whereas stricter regulations about diesel equipment usage in agricultural fields require DEF to achieve sustainable farming operations.

Technological Advancements

The DEF storage solutions, along with dispensing technology and distribution methods, continue to drive market expansion and deliver efficient results. Modern storage systems protect DEF quality by withstanding different temperatures and conditions.

In addition, automated dispensing units at fuel stations and fleet hubs make refilling easier while preventing contamination. Improved distribution networks, including bulk delivery systems, also guarantee a steady and cost-effective DEF supply, especially for heavy commercial vehicles.

Global Market Overview and Regional Analysis

On-road vehicles, off-road machinery, and industrial equipment depend on DEF as their main operational component. Here’s a global market overview of DEF’s use in various sectors:

On-Road Vehicles

DEF is employed as an emission-reducing compound in heavy-duty trucks and buses for compliance with regulatory requirements, including the EPA rules in the U.S. The total use of DEF continues to grow because manufacturers keep upgrading older vehicles with SCR systems in addition to new installations in the aftermarket.

Off-Road Machinery

DEF consumption is growing in the construction industry and agricultural sector because off-road machines with SCR technology are being introduced to fulfill emission requirements. The combination of expanding environmental oversight with sustainability initiatives creates growing market demand for DEF.

This has been the case since 2014 when all new diesel engines between 175 and 750 horsepower started using DEF to meet Tier 4 standards. In the future, the demand for DEF will also increase with the rising need of off-road equipment for construction growth.

Industrial Equipment

The application of DEF reaches various industries primarily composed of manufacturing companies, mining facilities, and logistics operations that require diesel engines for their operations. The commercial market for DEF in industrial equipment expands because businesses aim to fulfill regulations while reducing their environmental impact.

Key Regional Markets

The adoption of DEF technology continues to rise across key geographic areas, including North America as well as Europe, and Asia-Pacific, for these reasons:

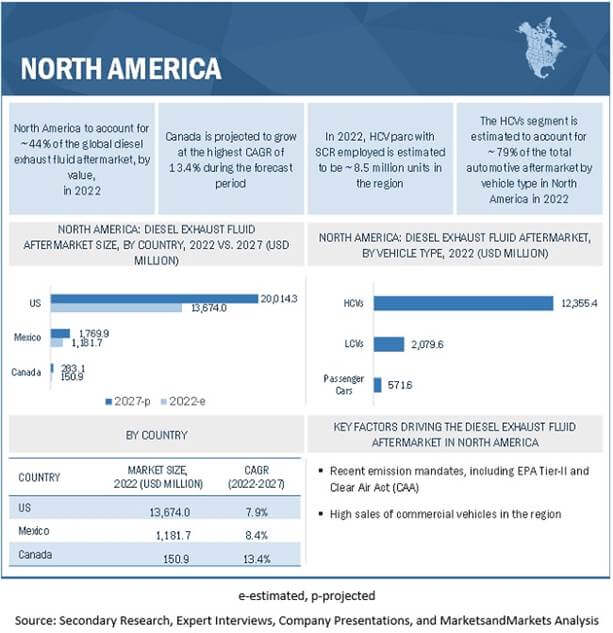

1. North America

The North American DEF market will expand to $22 billion during 2027 from its current value of $15 billion at an 8% annual growth rate. This is because the EPA demands NOx emission reduction from diesel vehicles with more than 3 liters production capacity made after 2010. As a result, SCR technology has become standard among 85% of truck manufacturer companies.

The DEF market demand increases because both new diesel vehicles entering the market and existing older diesel models require retrofitting with SCR systems. Dispensing pump availability for DEF has also significantly increased throughout the years, from 14% in 2011 to 40% in 2019, leading to better accessibility of DEF products.

2. Europe

The European DEF market reached $9.58 billion in 2024 before experts forecast an annual expansion of 8% between 2025 to 2030. European DEF demand keeps increasing because the Euro VI emission standards enforce NOx emission limits on diesel vehicles.

From 2014 onward, SCR technology spread across various markets because of these regulations, which require DEF for system operation. In fact, SCR systems became prevalent in 90% of new heavy-duty vehicle sales across Europe in 2020 due to industry-wide adherence to standards. DEF demand also increases steadily because the European Green Deal sets net-zero emission targets for 2050.

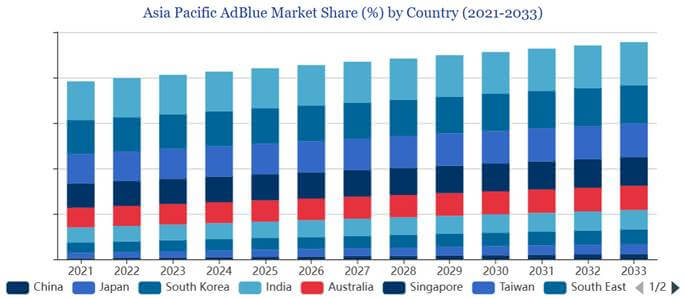

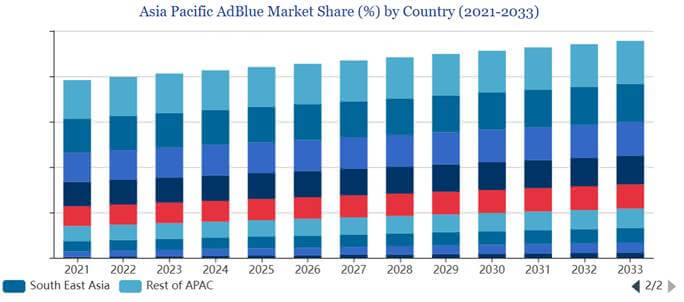

3. Asia-Pacific

According to market forecasts, DEF (also called AdBlue) revenue in the Asia-Pacific region achieved $7.71 billion in 2024, and this figure will increase by 9.6% annually through 2031. The commercial vehicle industry, consisting of trucks and buses, leads to increased DEF demand due to their significant diesel consumption and BS-6 regulations.

Market Projections Through 2030

The predicted DEF market expansion at a 7.9% CAGR from 2024 to 2030 could happen because of hybrid vehicles creating new possibilities in the market. Automobiles now unite diesel power systems with electric systems into one vehicle. The market shift might bolster progress in SCR technology for both systems and fluid formulations to improve the efficiency of hybrid applications.

As a result, new market opportunities can lead to DEF product development focused on hybrid vehicles. In addition to this, collaboration between DEF producers and automotive companies could likely drive innovation, improving production and distribution for hybrid vehicle applications. Meanwhile, diesel-powered vehicles in public transport and construction continue to drive DEF demand. As cities grow and infrastructure projects expand, the need for emission-compliant diesel machinery will sustain the market.

Challenges and Future Opportunities in the DEF Market

The DEF market demonstrates robust expansion potential even though it struggles with supply chain complications, increasing costs, and variable raw material prices. The market requires opportunities for innovation and new technology investments to establish sustainable methods to boost its stability. The following sections analyze both the upcoming possibilities and the problems that exist in the DEF market:

Challenges

- Supply Chain Issues: The DEF market operates at risk of substantial supply chain breakdowns due to global events like COVID-19. Multiple disruptions from geopolitical tensions like those between Russia and Ukraine are also future threats to the DEF market. Not to mention, the DEF manufacturers may suffer from shipping complications, such as port congestion and container shortages, which can lead to delayed deliveries and elevated prices.

- Production Costs: Higher energy expenses could lead to more expensive production of DEF because substantial energy usage is needed to manufacture this product. Transporting it also adds expenses as it’s a bulky liquid, especially in areas with few local producers.

- Fluctuating Raw Material Prices: The DEF market relies heavily on urea, whose price can fluctuate because it’s manufactured using natural gas. Thus, any supply issues in natural gas can cause urea price spikes. Seasonal agricultural demand for urea also competes with DEF production, affecting its prices.

Opportunities

- Innovation in DEF Alternatives: Developing alternative DEF formulations can improve SCR efficiency and reduce dependence on traditional materials, supporting sustainability.

- Investment in Complementary Technologies: Investments into complementary technologies surrounding hybrid and electric cars can generate suitable markets for optimized SCR systems.

- Sustainability Initiatives: Competitive advantage exists for firms that implement greener production methods and transparent supply chains to meet the active customer demand for eco-friendly products.

- Collaboration and Partnerships: Organizations achieve DEF solution advancement through collaborations between automakers and researchers who escalate innovation for new product development.

Key Takeaways From Industry Leaders

A rapid growth in the DEF market exists because of increased pollution regulations and governments worldwide prioritizing emissions purification. The market continues to grow despite supply chain problems, increasing prices, and volatile raw material costs because innovation and alternative solution investment remains strong.

Experts say that using DEF pushes automakers to adapt, but it also offers a chance to improve sustainability and create new solutions. Automakers also need to work with DEF producers to develop formulations for hybrid vehicles. Overall, the DEF market challenges businesses to keep up with new technology and growing sustainability demands.

FAQs

1. What is the future of diesel exhaust fluid?

DEF shows a bright path ahead due to rising emission regulations that fuel growing market needs. DEF utilization for SCR technology systems will expand significantly because governments are establishing stringent regulations about NOx emissions, particularly in the transportation and construction sectors. The upcoming EPA 2027 emission restrictions will also probably elevate the needed amount of diesel exhaust fluid.

2. How big is the diesel exhaust fluid market?

The DEF market shows robust expansion potential as it will rise from its current $34.4 billion value by 2022 to reach approximately $50 billion during 2027, with an annual growth rate of 7.8%. DEF market analysts predict it will expand up to $84.92 billion throughout the period between 2034 and 2035 due to heightened regulations and increasing diesel fleets.

3. Who is the largest manufacturer of diesel exhaust fluid?

TotalEnergies, Shell, BASF, Brenntag, and Sinopec represent the major DEF manufacturing companies in the market. The market positions of these companies have grown strong from mergers and acquisitions as their expansion strategy.

4. Why is there a shortage of DEF fluid?

DEF shortages are mainly due to fluctuating urea prices and production challenges. Urea demand in agriculture causes price shifts, and supply chain disruptions raise concerns.

5. How long will diesel exhaust fluid last?

DEF lasts about 12 months if stored properly in a cool, dry place away from heat and sunlight. With good storage, it can stay usable for up to two years, but contamination should be avoided.

6. What is a substitute for DEF fluid?

There are no widely accepted DEF substitutes yet, as it is essential for SCR technology. Ammonia-based alternatives are being explored but aren’t commercially viable. For now, DEF remains the main solution for cutting NOx emissions.

Get Premium Diesel Exhaust Fluid Delivery With Fuel Logic

Growing Diesel Exhaust Fluid market conditions could lead to industry-wide deficits. However, customers can obtain dependable DEF delivery through Fuel Logic. Our company delivers fast and top-tier fuel delivery services that maintain smooth operation for your fleet or equipment.

We offer a network of delivery services that reaches most U.S. cities to supply bulk DEF, diesel, and gasoline according to your needs. Our company also provides industrial off-road dyes for generators and standard on-road fuel for fleet transportation needs. You can order your DEF delivery now and benefit from cost reductions by dialing our company number or completing our online form!